UCC-Certified First-Lien Collateral Flow (90–120 DPD)

We Guarantee First-Lien Security to Accelerate Your Capital Deployment

100% UCC-Certified: The guaranteed path to acquiring or liquidating First-Lien Equipment Collateral.

Golden River Global is a Collateral Risk Auditor for the secondary equipment finance market. We connect institutional buyers with warranted portfolios sourced directly from regulated financial institutions, guaranteeing the underlying security interest via our proprietary UCC verification process.

About Us

The Challenge and Our Solution

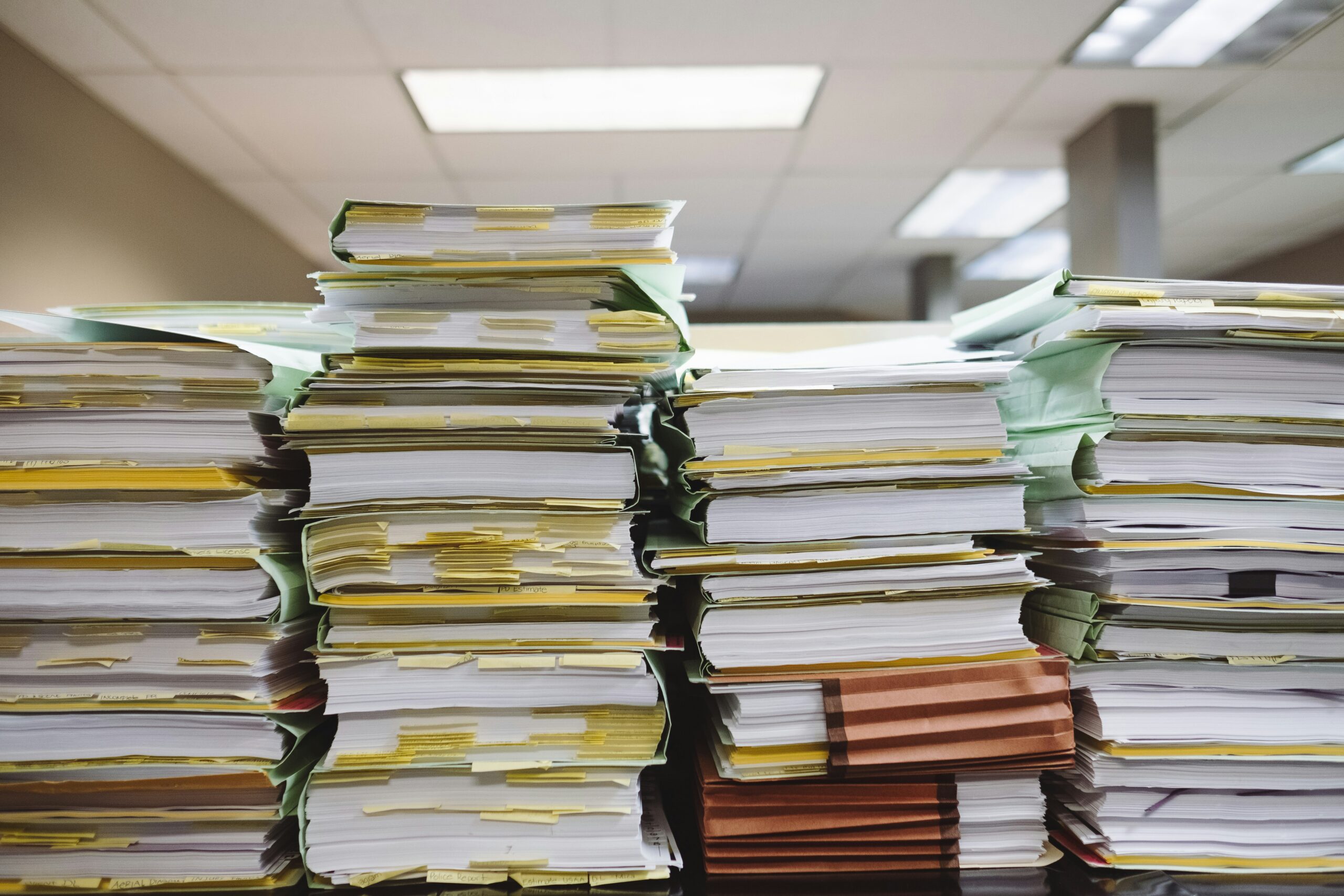

Every equipment finance lender and ABL Fund faces the same critical problem: the Collateral Gap. The value of a defaulted lease is tied to the physical asset (the collateral), but the enforceability of that asset’s claim is tied to the UCC-1 Financing Statement. The internal audit required to verify that the UCC-1 is valid, correctly filed, and maintains First-Lien Priority is slow, expensive, and a major operational bottleneck.

Golden River Global bridges this precise gap. We specialize exclusively in distressed B2B equipment collateral (90–120 DPD). Our solution is to perform the exhaustive legal and data verification before a portfolio ever reaches the buyer. We are a Collateral Risk Auditor who connects financial institutions ready to clear their balance sheets with institutional buyers focused purely on tangible assets.

Our process prioritizes security interest integrity, ensuring the documentation is clean and the claim is legally enforceable. We only handle business-originated equipment receivables, giving our institutional partners the confidence that every flow presented is UCC-certified, de-risked, and ready for immediate deployment of capital.

Accelerating Value for Both Sides of the Market

For Originators: Clear Capital, Not Just Debt

Unlock Immediate Capital

Unlock Immediate Cash

Minimize Regulatory Drag

Save Time & Resources

Streamline Asset Recovery

Clean Your Balance Sheet

Guaranteed Finality

Non-Recourse Process

For Buyers: Access Warranted Collateral Flow

Golden River Global transforms the secured equipment finance market by eliminating legal friction. We help originators efficiently exit their defaulted assets, while providing institutional buyers direct, exclusive access to a UCC-certified, risk-eliminated collateral flow. This partnership ensures every acquisition is instantly underwritable and accelerates your capital deployment cycle.

Guaranteed Forward Flow

Consistent Flow, Vetted to Your Buy Box Access continuous, pre-vetted equipment collateral opportunities that match your specific investment criteria.

Pre-Audited Security Interest

Streamlined Due Diligence Receive a certified package with UCC verification, eliminating the internal legal costs and time commitment.

Risk-Eliminated Acquisition

Targeted Collateral Integrity Focus your acquisition strategy only on assets where First-Lien Priority is contractually guaranteed.

Warranted Data Confidence

Reliable Sourcing Partner Work with an intermediary whose firm warrants the integrity of the P&I balances and supporting documentation.

Ready to Accelerate Your Value?

How It Works

Our Streamlined Certification Process

Source & Identify

We exclusively identify financial institutions and equipment lenders holding defaulted B2B assets secured by high-value equipment collateral (90–120 DPD). We secure an exclusive brokerage mandate and receive the raw loan tape and supporting documentation.

Certify & De-Risk

This is our core value. We perform a proprietary UCC-1 Audit on every asset, validating First-Lien Priority and verifying the data integrity. We then issue a Portfolio Warranty Statement confirming the assets are underwriting-ready, effectively eliminating the buyer’s internal due diligence phase.

Execute & Flow

We match the certified package with our specialized ABL partners who have already certified our audit process. This facilitates a swift, non-recourse transaction that accelerates the seller's balance sheet exit and immediately deploys the buyer's capital.

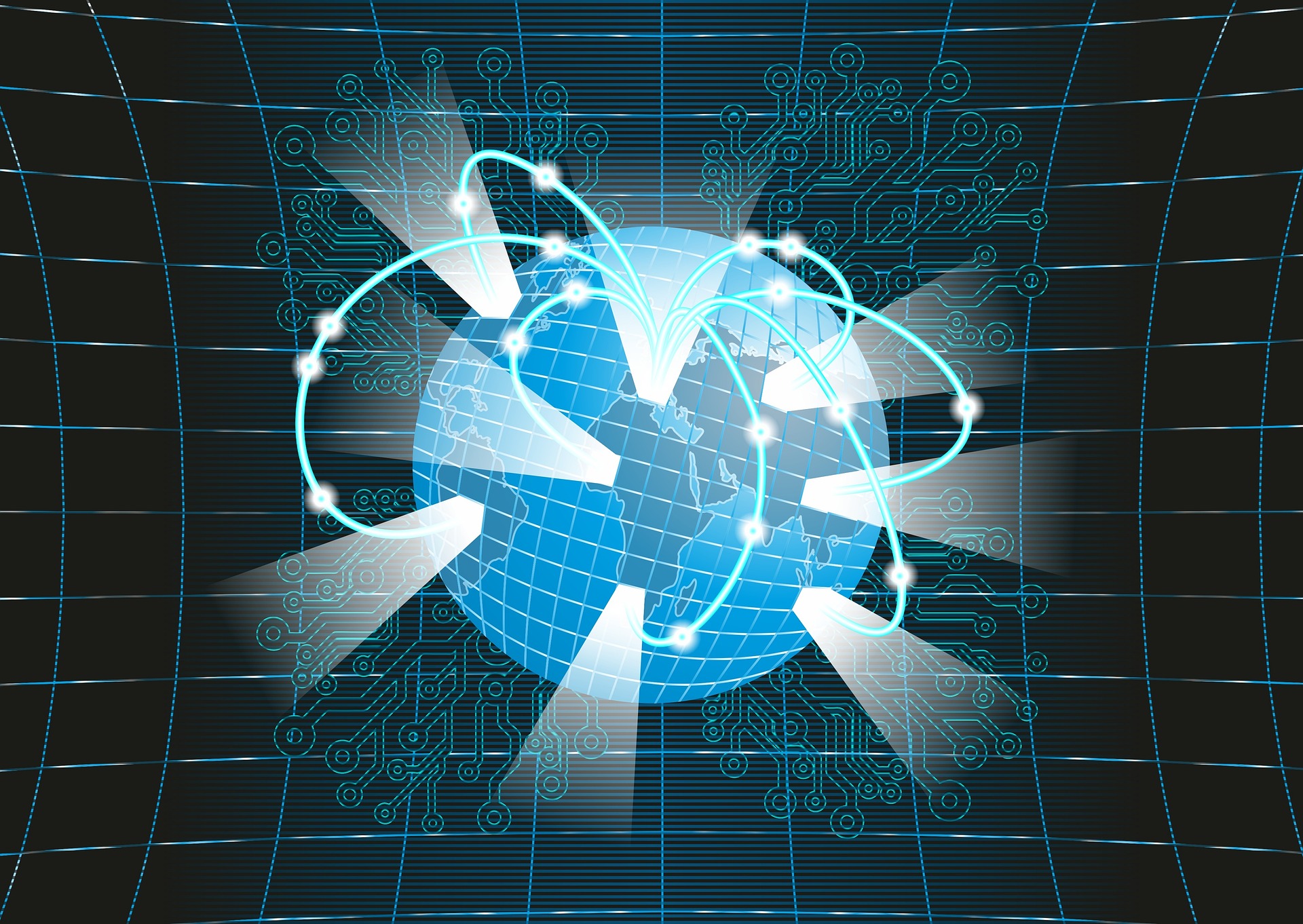

INSTITUTIONAL REACH

Golden River Global: We source, certify, and place first-lien B2B collateral with mandates across all major global financial centers.

UCC-CERTIFIED TRANSACTION INTEGRITY

For Direct Inquiries

| For Direct Inquiries, our focus is on First-Lien Collateral Assurance and Audit-Ready Documentation—ensuring seamless, risk-free execution for institutional buyers and definitive capital exit for sellers. |

LATEST NEWS & INSIGHTS

- For Sellers

By Sarah Jenkins, Operational Efficiency Expert In the world of SaaS, IT,...

- For Buyers

For investors looking to capitalize on the lucrative commercial debt market, the...

- Market Trends

The commercial debt landscape is constantly shaped by economic forces, technological advancements,...

- For Buyers

For savvy investors, commercial debt portfolios represent a compelling alternative asset class,...

- For Sellers

For any business, the sight of overdue invoices is a familiar one....

- Buyers/Sellers Market Overlap

For SaaS businesses, Monthly Recurring Revenue (MRR) is king. It’s the lifeblood...

- Market Trends

As we move deeper into 2025, the commercial debt market continues to...

- The Golden River Global Advantage

The world of commercial debt can often feel complex, opaque, and challenging...

- For Sellers

No business sets out to accumulate debt, especially not from its own...

- For Buyers

In the dynamic world of alternative investments, sophisticated buyers are constantly seeking...

- For Sellers

By Sarah Jenkins, Operational Efficiency Expert In the world of SaaS, IT,...

- For Buyers

For investors looking to capitalize on the lucrative commercial debt market, the...

- Market Trends

The commercial debt landscape is constantly shaped by economic forces, technological advancements,...

- For Buyers

For savvy investors, commercial debt portfolios represent a compelling alternative asset class,...

- For Sellers

For any business, the sight of overdue invoices is a familiar one....

- Buyers/Sellers Market Overlap

For SaaS businesses, Monthly Recurring Revenue (MRR) is king. It’s the lifeblood...

- Market Trends

As we move deeper into 2025, the commercial debt market continues to...

- The Golden River Global Advantage

The world of commercial debt can often feel complex, opaque, and challenging...

- For Sellers

No business sets out to accumulate debt, especially not from its own...

- For Buyers

In the dynamic world of alternative investments, sophisticated buyers are constantly seeking...